Charge Credit Card

mokafaa program

mokafaa program Allows You To Earn 1 Point Domestic Per SAR 1 In Your Purchasing And 2 Points In International With Your Card.

0% Monthly Profit Margin

3D Secure

More secure than cash, Enhanced online shopping protection with one time passwords.

Classic Charge Credit Card

Classic Charge Credit Card is the ideal companion when you need to spend a little more than you can afford in cases of emergency or essential needs.

Card Features

Get key features and conveniences with card, designed to enhance your banking experience.

0% Monthly Profit Margin

More Cards

Additional Cards For Family Members.

mokafaa program

mokafaa program Allows You To Earn 1 Point Domestic Per SAR 1 In Your Purchasing And 2 Points In International With Your Card.

Instant Notifications

Free alerts to track your finances effortlessly.

mokafaa Program

Earn 25,000 welcome mokafaa points when spending 15,000 in the fist 90 days from the card issuance date.

3D Secure

More secure than cash, Enhanced online shopping protection with one time passwords.

Contactless Payments

Enjoy fast and easy payments with (NFC) technology through MADA Pay, Samsung Pay, and Apple Pay, allowing you to pay for your purchases directly at point-of-sale terminals.

Card Benefits

- Paying 100% of the monthly Card statement.

- Mokafaa program Allows You To Earn 1 Point Domestic Per § 1 In Your Purchasing And 2 Points In International With Your Card.• Redeem your mokafaa points at over 100 merchants using your mobile number directly.• Convert your mokafaa points to flyer miles via Al Rajhi bank app.• Transfer reward points to any Alrajhi bank customer registered in the program.• Donate and transfer reward points to one of the charitable societies listed in the program.

- 0% Tasaheal Program You Can Convert Your Transactions Into Equal And Flexible Monthly Installmentswith 0% Profit Margin And ZERO Processing Fee Through Program Partners

- Safe Online Shopping.

- 0% Monthly Profit Margin

- Cash Withdrawal, Local & international cash withdrawal up to 30% of your credit limit.

- Instant Discounts, Enjoy a unique collection of offers and experiences across travel, dining, wellness and more with your your Card.

| Fee | Schedule of Charges |

|---|---|

| Card issuance | 425 SAR |

| Annual fees | 370 SAR |

| Supplementary Card issuance fee | 360 SAR |

| Supplementary Card Annual fees | 335 SAR |

| Foreign Transaction Fee | 2% |

| Request to increase/decrease the temporary credit limit | Free |

| Replacement fees | § 15 |

| Cash Withdrawal fee (Alrajhi bank ATM’s) | 3% of the transaction amount, with a maximum of SAR 9 |

| Cash Withdrawal fee from domestic / international ATM’s bank | 3% of the transaction amount, with a maximum of SAR 18 |

| Amount Transfer from card to current account | 3% of the transaction amount, with a maximum of SAR 9 |

| Wrong Dispute | § 25 |

| Cash Withdrawal (Adding money to e-wallets) | Free |

* Effective Date July 19, 2025

Bank Account

Existing bank account with alrajhi bank.

National ID/Iqama

Copy Of Valid ID (National ID/Iqama)

Salary Certificate

Salary certificate mentioning employments from employee

Application Form

Fill & submit application form.

Terms of Conditions

Approve the terms and conditions

Credit Card Calculator

Please note that this calculator only helps you calculate the approximate financing amount and does not represent the exact amount of financing and payments. For actual approval details, please contact us at 8001241222

APR

0*

Payable Period in Months

0*

How to apply

Apply Now

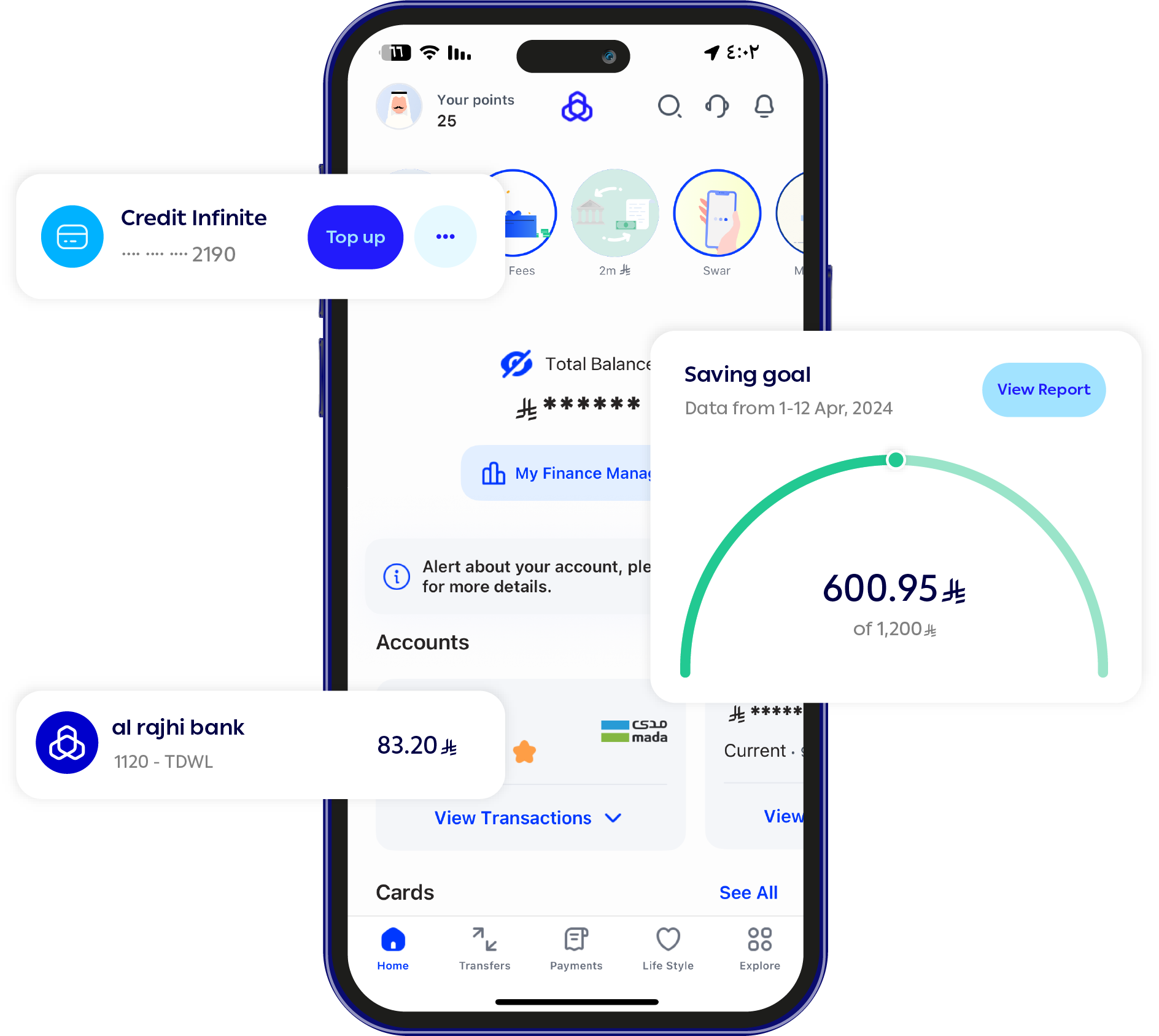

Apply via Al Rajhi Bank Online

Call Now

We're here to help—just give us a call

Via Branches

There is always a branch nearby

Frequently Asked Questions:

Get answers to the most frequently asked questions about our service.