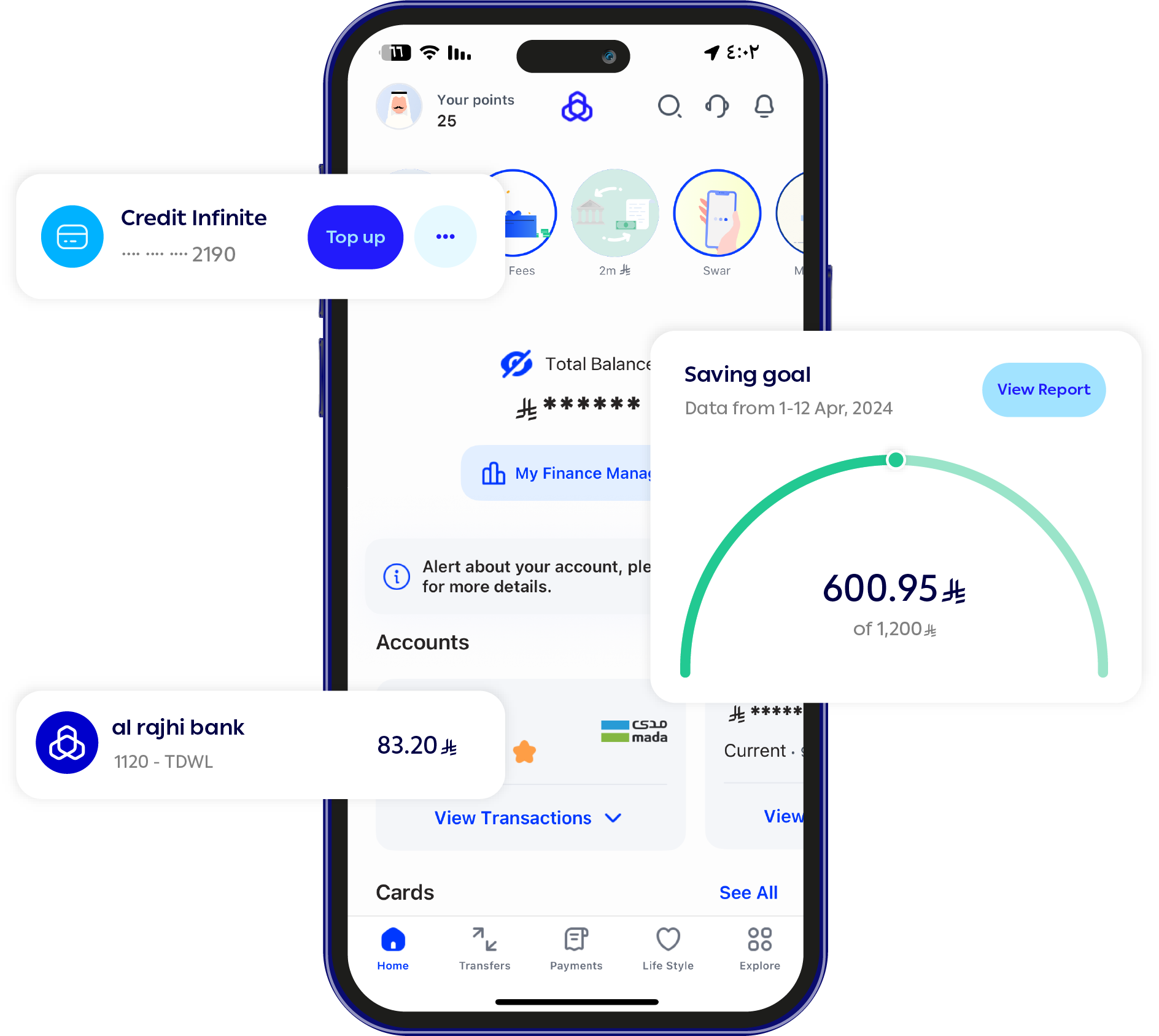

Credit Card

airport lounge access

Access to over 1,200 global airport lounges

Mokafaa program

Earn 150,000 welcome mokafaa points when spending 25,000 in the first 90 days from the card issuance date.

Complimentary Airport Transfers & Valet Parking

Enjoy free airport transfers and complimentary valet parking with no extra cost. Terms & Conditions apply

Infinite Credit Card

Al Rajhi Bank introduces the Infinite Credit Card based on Murabaha finance to offer you the ultimate flexibility and many unique features.

The card is based on giving you a fully Sharia compliant finance, and then deposit the funds in your card account to use it on purchases or cash withdrawals.

Card Features

Get key features and conveniences with card, designed to enhance your banking experience.

airport lounge access

Access to over 1,200 global airport lounges

Mokafaa program

Earn 150,000 welcome mokafaa points when spending 25,000 in the first 90 days from the card issuance date.

Global Access

Accepted at over 30M+ local & international POS and 900,000 ATMS worldwide.

Cash Withdrawal

Local & international cash withdrawal up to 30% of your credit limit

Near-field Communication (NFC)

Enjoy fast and easy payments with (NFC) technology through MADA Pay, Samsung Pay, and Apple Pay, allowing you to pay for your purchases directly at point-of-sale terminals.

3D Secure

More secure than cash, 3D secure uses a verification process, one time password for online shopping and EMV chip to protect your information.

Instant Notifications

Instant notifications, a free service that sends you a notification messages to stay on the top of your finances with ease and convenience.

Complimentary Airport Transfers & Valet Parking

Enjoy free airport transfers and complimentary valet parking with no extra cost. Terms & Conditions apply

Card Benefits

- Access to 1,200 global airport lounges through the Visa Airport Companion app.

- Complimentary Travel Insurance provided by Visa International.

• Purchase protection lost, stolen or damaged goods purchased using credit cards.

- Extended Warranty For Purchases Using Your Credit Card.

- 24/7 All day global Concierge services that can assist you with your needs, flights bookings, hotels, car rental, and events tickets etc.

Please call +8008443488 or +97143611234 or through WhatsApp services +447520631645 to take advantage of this service.

- Mokafaa Program Allows You To• Earn 3 Points Per SAR 1 Domestic Spend And 5 Points On International Spend With Your Card• Earn 150,000 welcome mokafaa points when spending 25,000 in the first 90 days from the card issuance date.

- Free Additional cards for your immediate family members, give them the same features and benefits as per your primary card. In addition to:• Controlling the credit limit of the additional card• Receiving the credit limit of the additional card• Sending notifications and verification codes directly to the additional cardholder

- 0% Tasaheal Program You can convert your transactions into equal and flexible monthly installments with 0% profit margin and ZERO processing fee through program partners

- Enjoy the flexibility of paying as low as 5% of your monthly card statement.

- “Visa checkout” the easier pay online service

- Instant Discounts, enjoy a unique collection of offers and experiences across travel, dining, wellness and more with your Credit Card

- Exclusive perks with Kiwi Collection, the world’s largest and most diverse and curated collection of luxury hotels including:• Automatic room upgrade upon arrival, when available• Late check-out upon request, when available• $25 USD food or beverage credit• Complimentary continental breakfast daily

| Schedule of Charges | Fee |

|---|---|

| Annual Primary Card | SAR 990 Now Zero issuance fees and Annual fees valid till 31 of December 2025 |

| Supplementary Card | 2 free cards SAR 50 for each Additional Card |

| Monthly Profit Rate | 2.2% |

| Monthly Minimum Payment | 5% or SAR 100 Whichever is higher |

| Additional fee on International Transactions | 2% |

| Replacement | SAR 15 |

| Cash Withdrawal (via ATM)/Transfer from card to current account | 3% for transactions below SAR 2500, with a maximum limit of SAR 75 for transactions equal to or above SAR 2500 |

| Wrong Dispute Fee | SAR 25 |

| Inquiry at ATM | SAR 1.5 |

| Cash Withdrawal (Adding money to e-wallets) | Free |

Example: Descriptive Examples showing the APR based on the credit limit

| Example | 1 | 2 | 3 |

|---|---|---|---|

| Due Amount | SAR 75,000 | SAR 100,000 | SAR 150,000 |

| APR | 26.97% | 26.19% | 25.4% |

| Finance APR | 23.88% | 23.88% | 23.88% |

| Minimum Payment Amount | 5% | 5% | 5% |

| Months Until Balance Repaid | 140 Months | 149 Months | 162 Months |

* If the minimum payment amount made every month, it will take almost the months that appeared for each product in table to repay the full amount, keeping in view compounded interest added each month.

*APR may change based on the change in the financing amount and due date.

Bank Account

Existing bank account with alrajhi bank.

National ID/Iqama

Copy Of Valid ID (National ID/Iqama)

Salary Certificate

Salary certificate mentioning employments from employee

Application Form

Fill & submit application form.

Terms of Conditions

Approve the terms and conditions

Credit Card Calculator

Please note that this calculator only helps you calculate the approximate financing amount and does not represent the exact amount of financing and payments. For actual approval details, please contact us at 8001241222

APR

0*

Payable Period in Months

0*

Foreign currency Calculator

Please note that this calculator only helps you calculate the approximate foreign currency amount and does not represent the exact amount.

Cardholder Billing Amount

SAR 0

Markup Fee

SAR 0

VAT

SAR 0

How to apply

Apply Now

Apply via Al Rajhi Bank Online

Call Now

We're here to help—just give us a call

Via Branches

There is always a branch nearby

Frequently Asked Questions:

Get answers to the most frequently asked questions about our service.