Personal Finance Refinance

Why Refinance?

Get the best financing possible

The bank provides the possibility of consolidating the customer’s obligations from the personal finance contracts with the bank in one contract by paying them through a third party. A maximum financing is implemented so that the third party contract is paid and the rest of the finance amount is available in the customer’s account. The product is also available to customers who have one personal finance.

Features:

- Annual rate starts from 3.32%

- Earn 6,000 mokafaa Points when you apply for refinance via alrajhi bank app

- You can get Watani financing with a maturity period of up to 60 months *

- Competitive profit margin ratio

- The speedy completion of all procedures for the customer’s financing request

- Enable the customer to benefit from the financing products and other services provided by AlRajhi Bank

- Possibility of financing retired customers

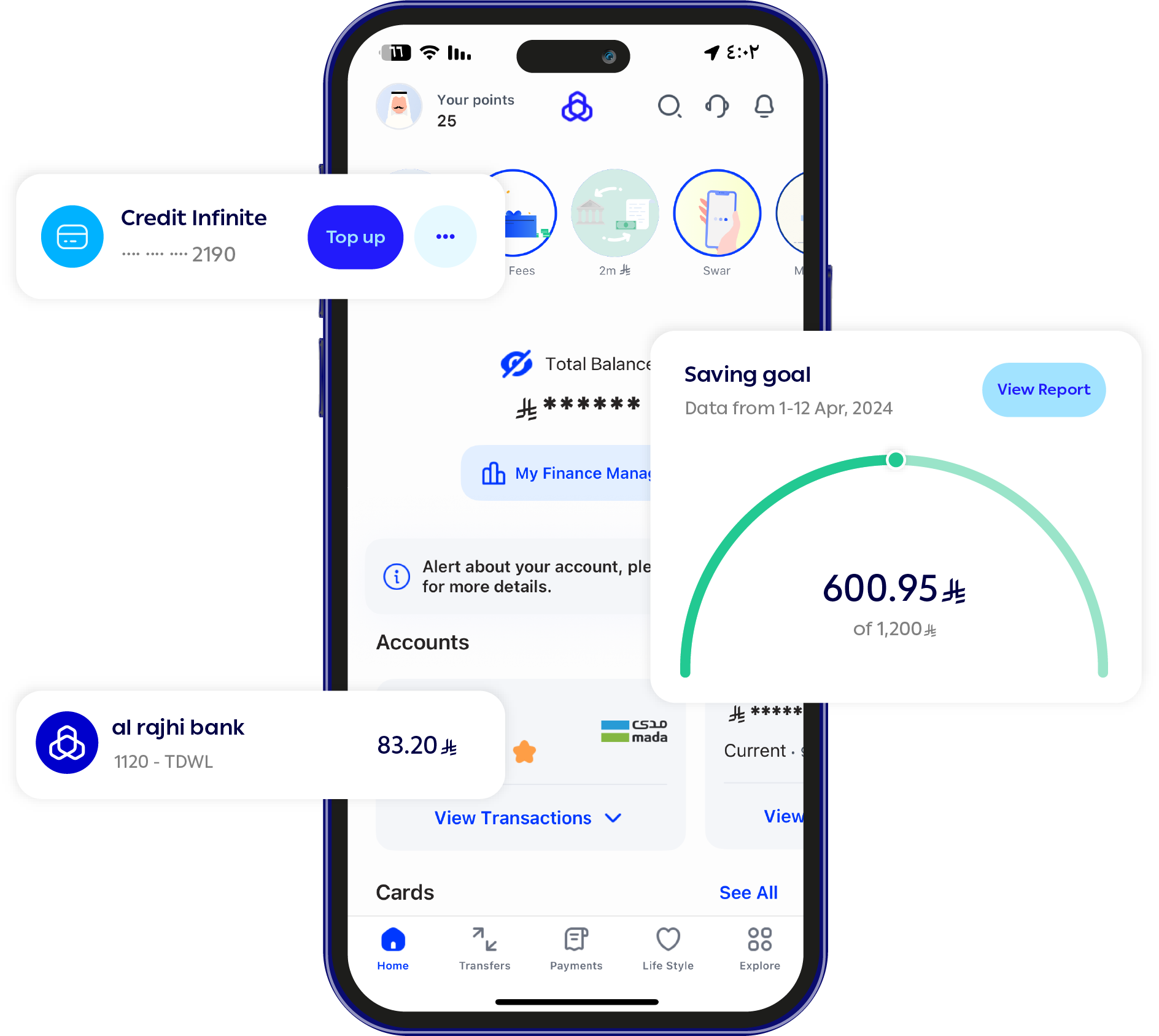

- The ability to apply for a financing and implement it directly through the application

- Possibility of early repayment at any time based on the customer's request

- No guarantor is required to obtain financing

- A financing amount of up to 2.5 million SAR

- Exemption from indebtedness in the event of death or total disability, God forbid

*Terms and Conditions apply

Product Terms and Requirements:

Nationality

That the customer is citizen on the job or retired

Employer

That the customer is an employee of one of the approved employers within the bank.

Minimum Age:

18 years for citizens

Minimum Salary:

- For citizens: 2000 riyals and 1900 for retirees

- For residents: 5000 riyals

Customer Age:

The age should not exceed 60 years for employees and 75 years for retirees (when paying the last installment)

Required Documents:

- National identity card

- Salary definition

- Salary fixation

- Financing application form

How much money can you borrow?

| Financing Amount | Maturity In Years | APR | Monthly Installment Amount |

|---|---|---|---|

| SAR 150,000 | 5 | 6.43 % | SAR 2,884 |

| SAR 5,000 | SAR 353,357 | SAR 477,454 | SAR 2,500 |

| SAR 5,000 | SAR 353,357 | SAR 477,454 | SAR 2,500 |

| SAR 5,000 | SAR 353,357 | SAR 477,454 | SAR 2,500 |

| SAR 5,000 | SAR 353,357 | SAR 477,454 | SAR 2,500 |

Personal finance calculator

Please note that this calculator only helps you calculate the approximate financing amount and does not represent the exact amount of financing and payments. For actual approval details, please contact us at 8001241222

Your Monthly Payment SAR

0*

Your Finance Amount SAR

0*

Total Amount Payable SAR

0*

APR

0*

How to apply

Apply Now

Apply via Al Rajhi Bank Online

Call Now

We're here to help—just give us a call

Via Branches

There is always a branch nearby