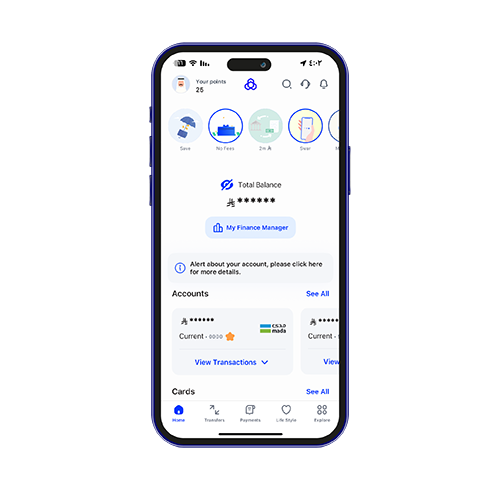

Banking at Anytime & Anywhere

Enjoy faster, easier banking anytime with our 24/7 services

Banking experience matching your needs

Choose your experience

Classic

With Mada Classic Card

Affluent

With Platinum Debit Card

Affluent Diamond

With Signature Debit Card

Private Banking

With Mada Infinite Card

E-commerce Shopping Week!

Whatever you want delivered to you with E-com offers with our cards!

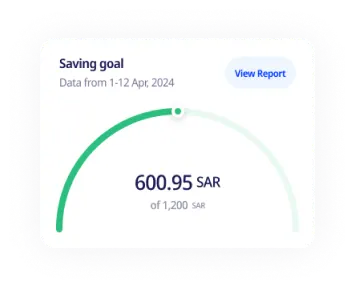

Our Programs

welcome to the world of mokafaa

We value your time with us, which is why mokafaa loyalty provides a rewarding loyalty experience.

Explore mokafaaWhat's New at alrajhi bank

Abdullah Al Rajhi: alrajhi bank Delivers an Outstanding Performance in 2025, recording Net Income of SAR 24,792 Million, Driven by Business Growth and Operating Efficiency

Abdullah Bin Sulaiman Al Rajhi: The recommendation to increase capital is a strategic step that supports expansion, sustainable growth, and strengthens the Bank’s financial position

alrajhi bank Launches “Powr” Card, the First of Its Kind in the Region, in Partnership with Leading Esports Team

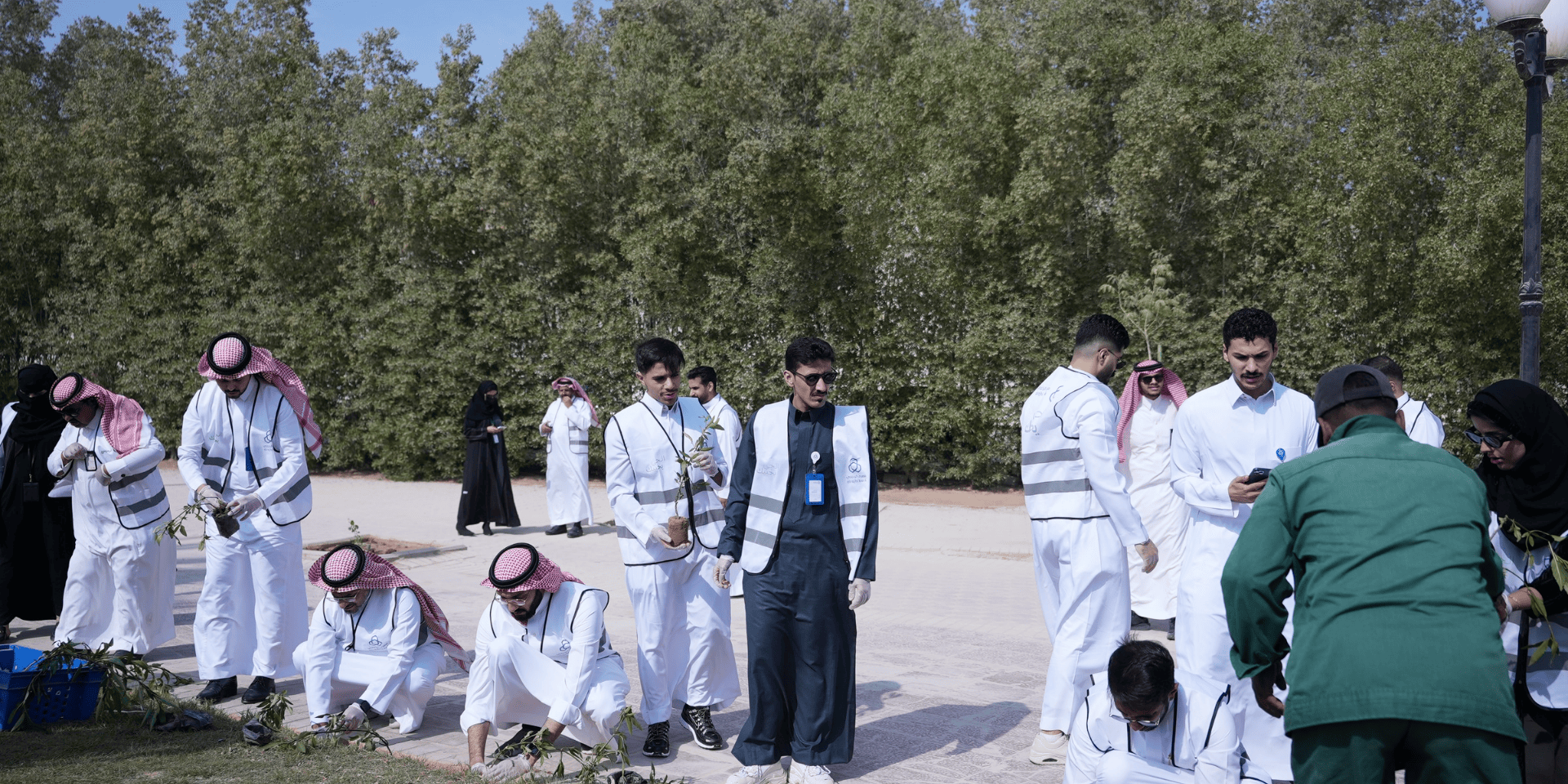

alrajhi bank Contributes to the “Riyadh Volunteers” Campaign with the Participation of 200 Employees

alrajhi bank and the Martyrs Fund Launch the First Phase of the “Dar Shahm” Initiative to Build 50 Housing Units

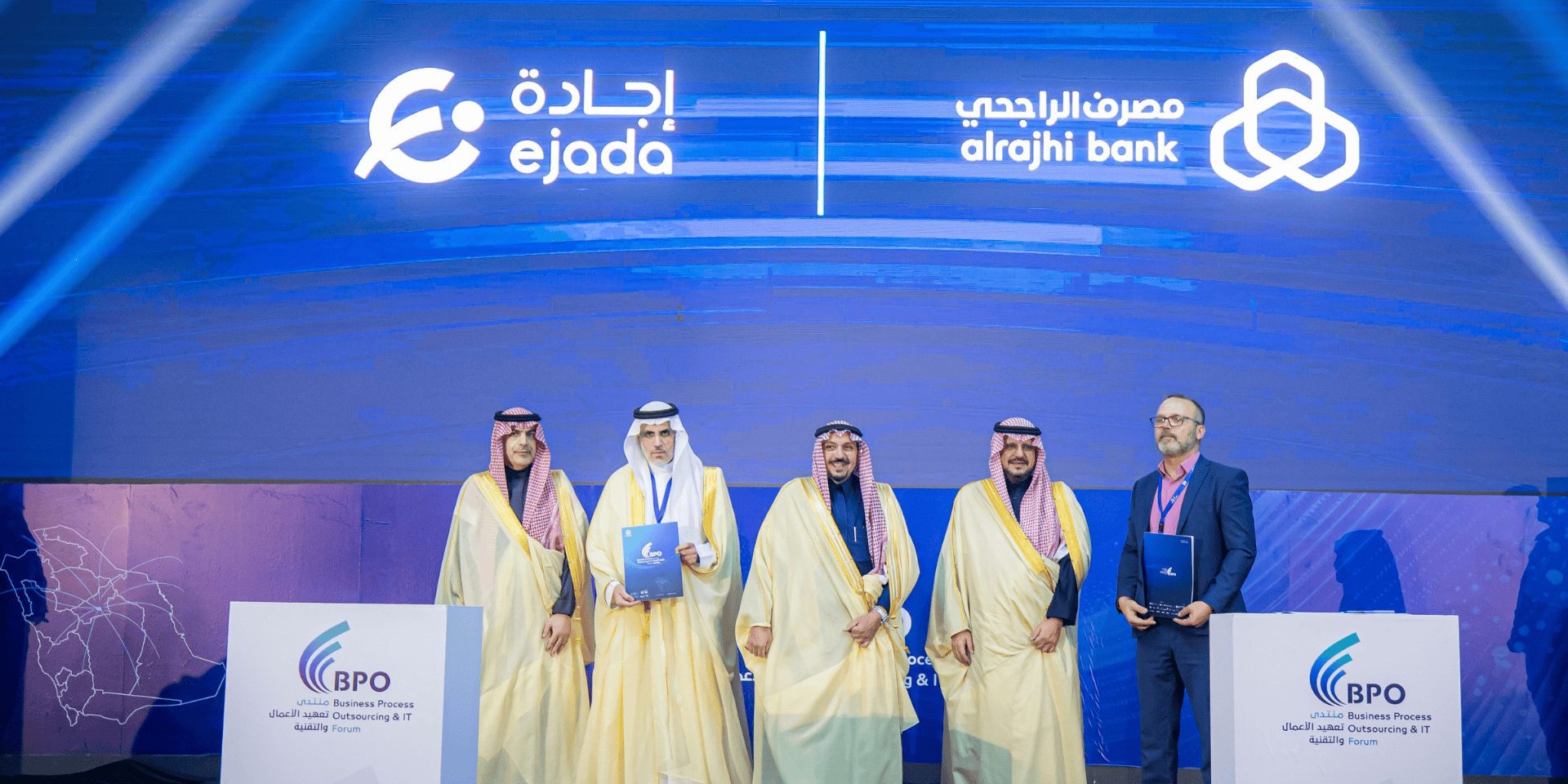

alrajhi Bank and Ejada Systems Sign MoU to Enhance Data Center Readiness and Support Digital Transformation Initiatives

Our Numbers Speak’s up

Founded in 1957, Al Rajhi Bank is one of the largest banks in the world. Committed to providing you the best services and products for all your financial needs.

Total assets (SAR)

1,043 Billion

Customer members

19 Million+

ATM’s closest to you

4,322

Branches across the country

537

Net profit (SAR)

24.79 Billion

2025 Financial Results