Auto Murabaha Finance

We strive to provide quality service with our flexible, Shariah-compliant Car Finance product, making car ownership quick and easy. We purchase your chosen car from a partner dealer, finance it for you, and you pay monthly installments—all while the car is registered in your name.

Product details

- Quick approvals

- Allows customer to acquire cars financing in a Shari'a compliant manner

- Flexible financing Tenor

- No hidden charges

- Competitive Profit Rates

- No Early Settlement Penalty

- Simple Documentation

Examples

| Finance Amount | Maturity in years | APR | Monthly Payment Amount |

|---|---|---|---|

| 100,000 | 5 years | 5.5% | 1,901 |

| 90,000 | 4 years | 5.47% | 2,063 |

| 150,000 | 3 years | 5.67% | 4,479 |

Definitions

Illustration:

| Finance Amount | Maturity in years | APR | Monthly Payment Amount |

|---|---|---|---|

| 100,000 | 5 years | 5.5% | 1,901 |

*APR may differ depending on the amount and the maturity period different from above and subject to credit scoring of each customer.

The Annual Percentage Rate (APR):

It is the discount rate at which the present value of all payments and installments that are due from the Borrower, representing the Total Amount Payable by the Borrower, equals the present value of all payments of the Amount of Financing available to the Borrower on the date on which the Financing amount or the first payment thereof is available to the Borrower.

Finance Amount:

The contract stipulates the amount of financing you will receive in addition to the period of repayment of the installments, stating their value and the maturity date of these installments. The data also include the cost of obtaining funding in terms of knowing the fixed term cost rate and management fees.

Maturity In Years:

The duration of the contract agreed upon between the parties, which shall indicate the date and expiry of the contract with the parties with the terms of the contract.

Monthly repayment amount:

The last payment is usually to 50% of the car price which you decide to pay at the end of the lease. It makes the monthly rentals that you pay less, but you have to be ready to make a large payment at the end of the lease.

Definitions

Illustration:

| Finance Amount | Maturity in years | APR | Monthly Payment Amount |

|---|---|---|---|

| 100,000 | 5 years | 5.5% | 1,901 |

*APR may differ depending on the amount and the maturity period different from above and subject to credit scoring of each customer.

The Annual Percentage Rate (APR):

It is the discount rate at which the present value of all payments and installments that are due from the Borrower, representing the Total Amount Payable by the Borrower, equals the present value of all payments of the Amount of Financing available to the Borrower on the date on which the Financing amount or the first payment thereof is available to the Borrower.

Finance Amount:

The contract stipulates the amount of financing you will receive in addition to the period of repayment of the installments, stating their value and the maturity date of these installments. The data also include the cost of obtaining funding in terms of knowing the fixed term cost rate and management fees.

Maturity In Years:

The duration of the contract agreed upon between the parties, which shall indicate the date and expiry of the contract with the parties with the terms of the contract.

Monthly repayment amount:

The last payment is usually to 50% of the car price which you decide to pay at the end of the lease. It makes the monthly rentals that you pay less, but you have to be ready to make a large payment at the end of the lease.

Documentation Requirement:

National ID / Iqama

Copy of your National ID or Iqama for identity verification.

Valid Driving License

A valid driving license as proof of eligibility to drive.

Attested Salary Letter

An attested salary letter from your employer, showing income details.

Additional Income Documents

Proof of any additional income and bank statements for the past two years.

National ID / Iqama

Valid Driving License

Duly signed & attested Salary Letter with income breakup from employers attested by Chamber of Commerce.

Last 3 months Bank statements showing salary credits.

GOSI certificate

Any additional income documents for last 2 years in the form of proof of income & bank statements reflecting such income.

Eligibility and Criteria:

Minimum age 18 years.

Monthly Income starting from SAR 1,900.

Length of service starting from 1 month.

Fill & Submit Application Form.

Submit Now

How to apply

Apply Now

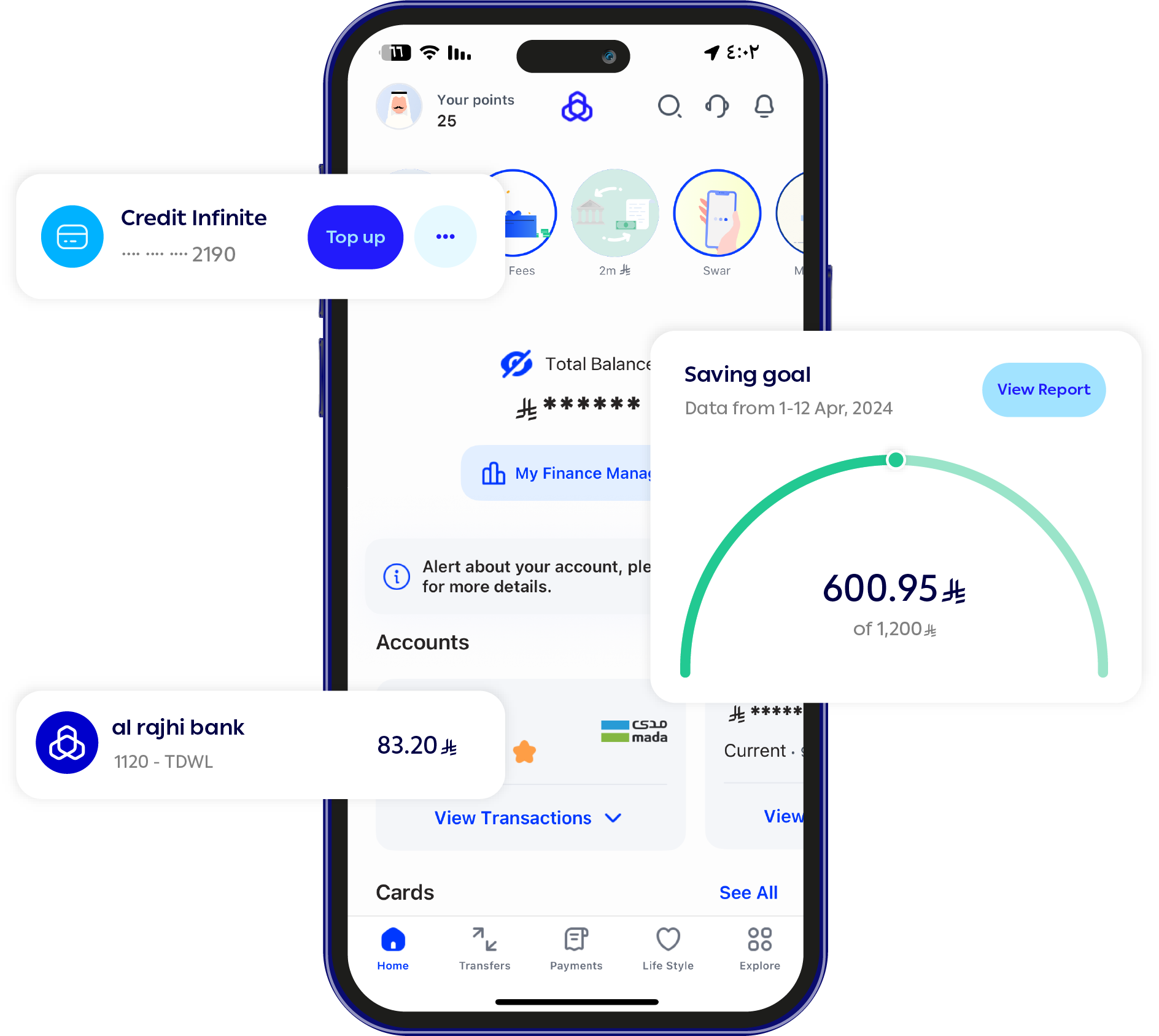

Apply via Al Rajhi Bank Online

Call Now

We're here to help—just give us a call

Via Branches

There is always a branch nearby