Expat Home Finance

Real estate financing facilitates expatriate ownership and settlement with an amount of up to 5 million SAR for alrajhi bank customers.

Features:

Financing period up to 20 years.

Financing amount up to 5 million riyals.

Shariah compliant financing.

Possibility of financing up to the age of 70 years.

Co-Borrowers feature for customers holding regular Iqama residency.

Financing the customer with or without salary transfer.

Quick and instant approvals.

Competitive and fixed profit margin throughout the financing period.

Possibility of financing all expat customers holding premium or regular residency (provided that the approval of the Ministry of Interior is provided for customers holding regular residency).

Terms and Required documents

Error: Invalid datasource

How much money can you borrow?

The first step for you is to explore the amount you can borrow. Typically, you can borrow up to 53 times your salary to buy a land. The tables will give you closer idea.

Single applicant

Joint applicants

Home Finance Calculator

Please note that this calculator only helps you calculate the approximate financing amount and does not represent the exact amount of financing and payments. For actual approval details, please contact us at 8001241222

Your Monthly Payment SAR

0*

Your Finance Amount SAR

0*

Total Amount Payable SAR

0*

APR

0*

How to apply

Apply Now

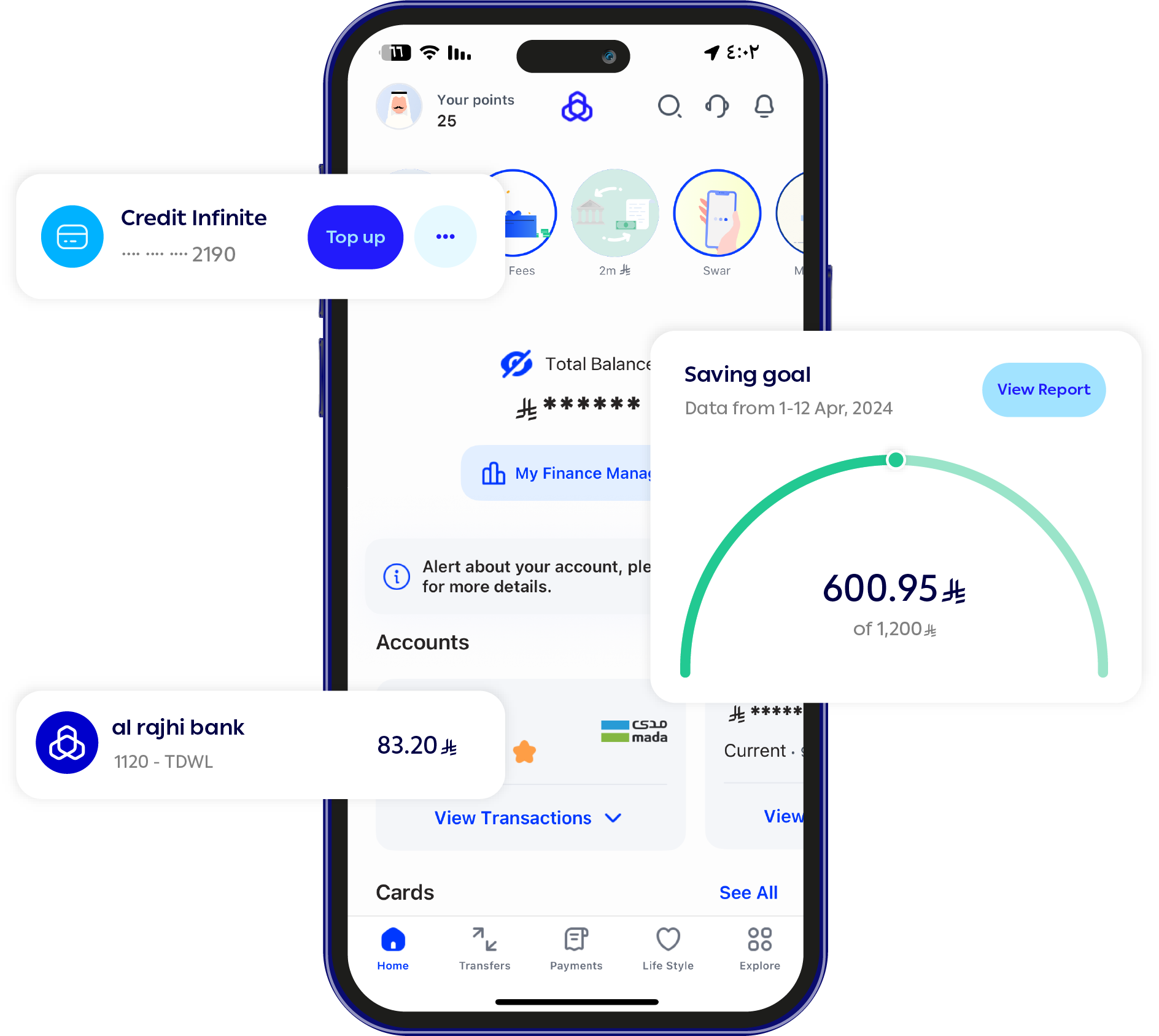

Apply via Al Rajhi Bank Online

Call Now

We're here to help—just give us a call

Via Branches

There is always a branch nearby