Self-Construction (Demolish & Reconstruct)

Customers can buy an old property and then demolish it and rebuild it according to the customer’s desire and based on the available credit limit.

Key Features of the Self - Construction

This concept falls under the umbrella of the self-Construction financing, where the customer can buy an old property and then demolish it and rebuild it according to the customer’s desire and based on the available credit limit.

Client Politics

The client must be a beneficiary of the Real Estate Development Fund or the Ministry of Housing.

Shariah financing

Shariah compliant financing

Repayment

Possibility of early repayment at any time at the request of the customer.

Payment support

Concessional financing

Up to 30 years

Financing period up to 30 years

Quick approvals

Quick and instant approvals

Profit margin

Competitive and fixed profit margin throughout the financing period

For all employers

Available for approved and un-approved employers

Up to 70

Financing up to the age of 70

For retired clients

Possibility of financing retired clients

Flexible

Flexible installment feature

Terms and Required documents

A statement of salary transfer from employer ( in case financed with salary transfer)

Buying an old property and transferring it in the name of the customer and mortgaging it to the bank

Copy of building permits

Monthly expense declaration form

Valid ID

Salary certificate from employer

Sketch of property location

The client obtains a demolition permit and demolishes the property

Minimum age of 18

The bank will make sure that the property is demolished and start paying the construction payments to the customer.

Construction batches are 4 or 5 batches depending on the customer segment.

Minimum service 3 months

Filling "financing" form

How much money can you borrow?

The first step for you is to explore the amount you can borrow. Typically, you can borrow up to 53 times your salary to buy a land. The tables will give you closer idea.

Single applicant

Joint applicants

Home Finance Calculator

Please note that this calculator only helps you calculate the approximate financing amount and does not represent the exact amount of financing and payments. For actual approval details, please contact us at 8001241222

Your Monthly Payment SAR

0*

Your Finance Amount SAR

0*

Total Amount Payable SAR

0*

APR

0*

How to apply

Apply Now

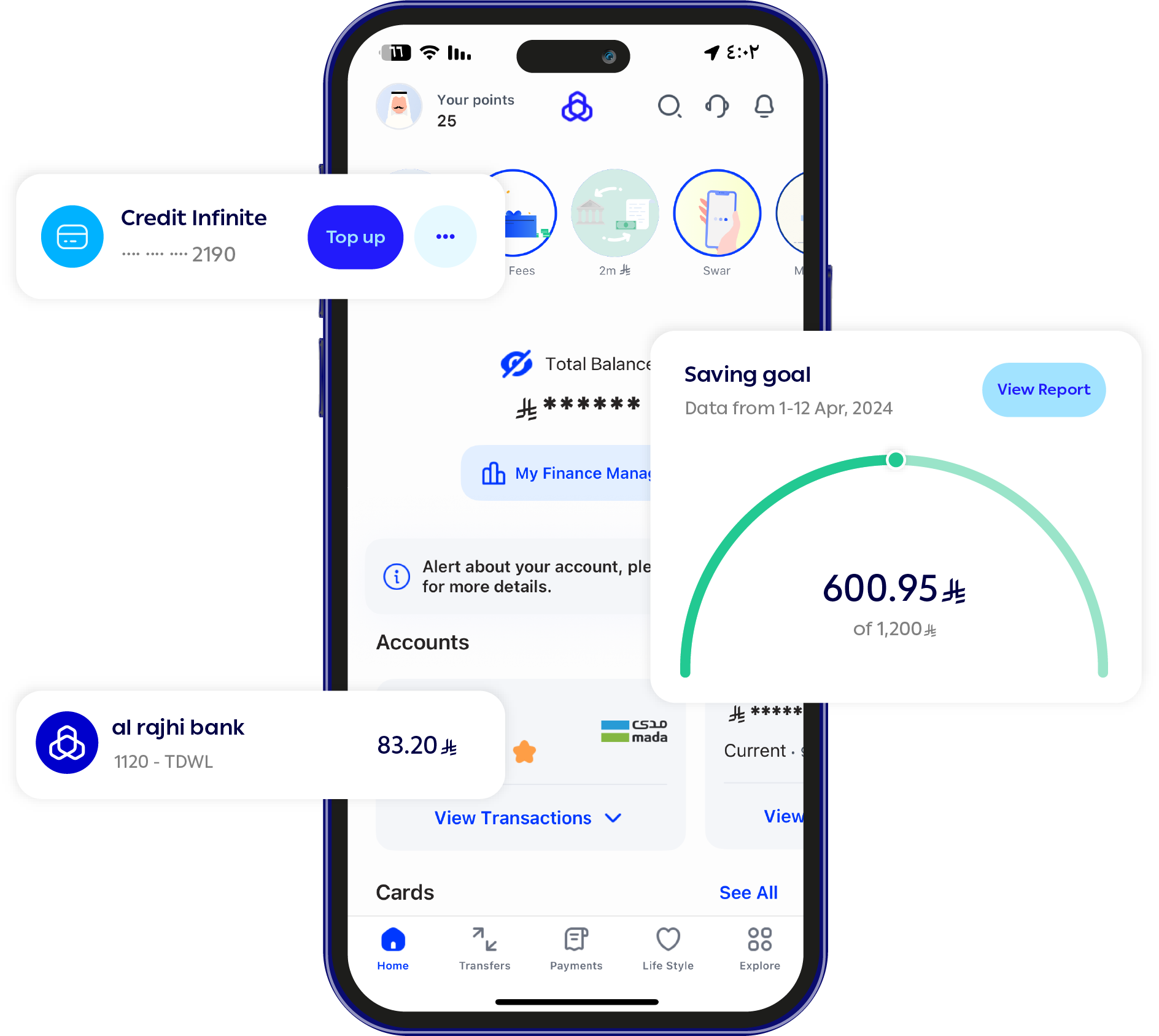

Apply via Al Rajhi Bank Online

Call Now

We're here to help—just give us a call

Via Branches

There is always a branch nearby

Frequently Asked Questions:

Frequently asked questions with concise answers for applications designed for full online workplaces for your tech startups