Real Estate Financing (Tharwa) for Retail Customers

Tharwa’s Buy-to-Let product empowers property owners and investors to unlock the value of their real estate by converting rental income into long-term financing

Tharwa Buy-to-Let: Turn Your Property into a Reliable Income Stream

Tharwa’s Buy-to-Let product empowers property owners and investors to unlock the value of their real estate by converting rental income into long-term financing. Whether you’re purchasing a new property or leveraging an existing one, Tharwa provides access to capital without requiring salary-based commitments.

Seamless transfer option

you can shift existing real estate finance from salary-based repayment to rental income repayment under Tharwa.

Fixed installments

Fixed installments and flexible payments throughout the financing term.

Tenure up to 20 years

Flexible terms to maximize affordability and yield.

Eligible for all types of income-generating properties

Residential or commercial units with a proven rental stream.

Financing up to SAR 25 million

Designed for individual investors and real estate portfolios.

Eligibility up to age 70

Inclusive financing across different investor profiles.

Terms and Required Documents:

Valid national ID/Iqama.

Property title deed

Ejar contracts

Proof of rental income (bank statement or Ejar Receipt)

Valid building permit

How to apply

Apply Now

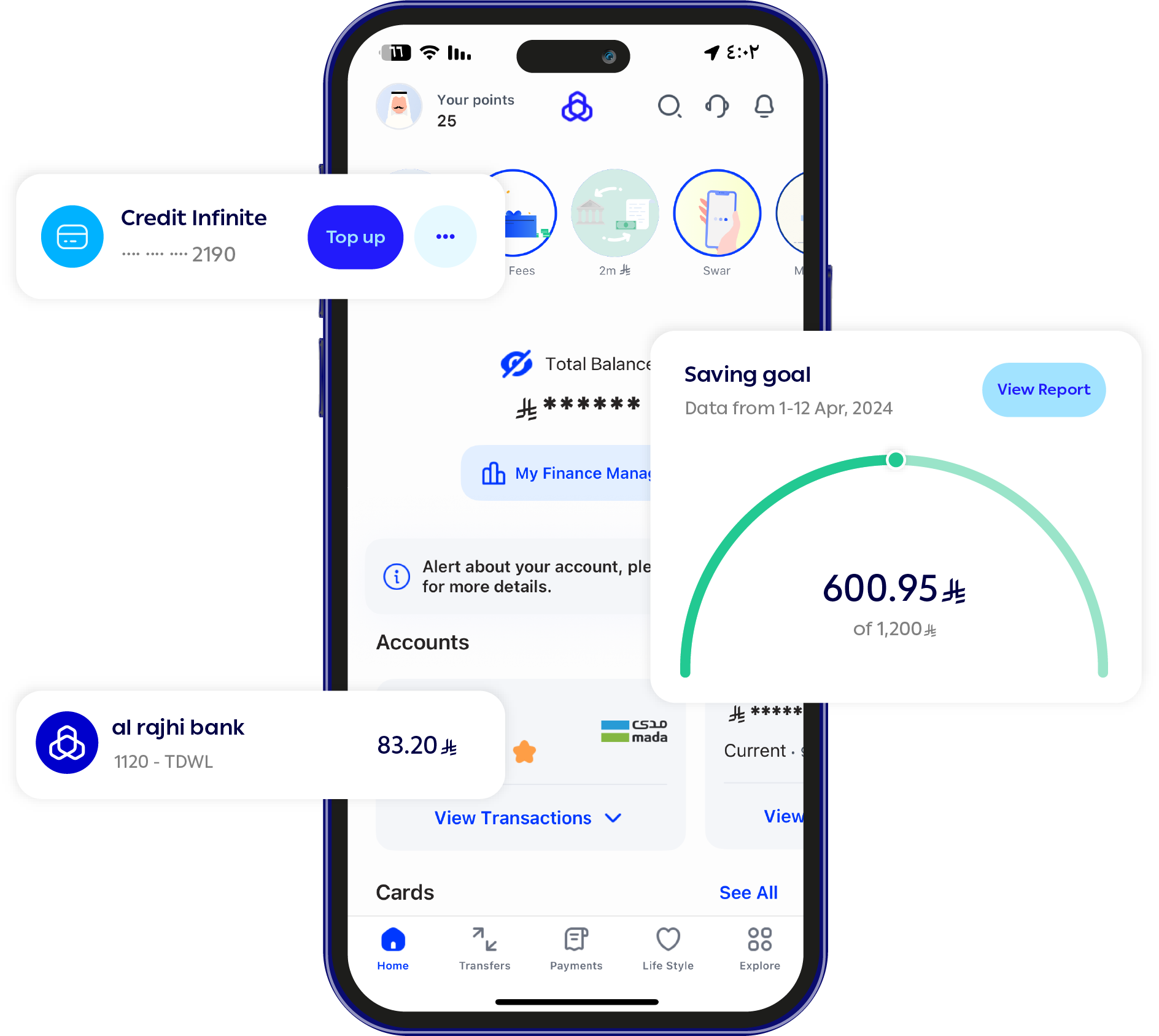

Apply via Al Rajhi Bank Online

Call Now

We're here to help—just give us a call

Via Branches

There is always a branch nearby

Frequently Asked Questions:

Frequently asked questions with concise answers for applications designed for full online workplaces for your tech startups